Banking and financial institutions which have traditionally run on trust and direct customer contact are now in the race to digitalize - not to compete, but to stay relevant. With customers who are increasingly relying on mobile and web applications for banking related transactions, banks have no option but to invest in digital banking products and services. Building a digital ecosystem on the pillars of continuous innovation is imperative and so is being secure.

The banking industry is fast transforming, driven by digital triggers and changing customer expectations in terms of speed and efficiency. Intelligent automation and open banking services are disrupting the existing operating models. Apart from providing exceptional customer experiences banks need to create hyper-personalized products and services. As competition from non-banking players like Fintech, big tech, and retailers increases, banks have to innovate quickly and cost-effectively. Artificial Intelligence, Blockchain and Crypto currencies are set to re-define banking and financial services as we know it. These smart technologies can support front, middle and back office operations, help to create customer- centric products, provide personalized user experiences automate transactions, streamline workflows and assist with security.

The future of money markets is likely to change exponentially in the Metaverse and regulations governing these markets will additional pressure on banks. Digital Channels are contributing a greater share to the topline growth. Investing in technology assets, collaborating with technology partners and leveraging shared systems landscape will help banks and financial institutions to navigate these challenges. CloudLeaf helps finance and banking organizations harness technological innovations to develop new applications, generate more value from their technology investments, and optimize their offerings with technology.

Benefits of using technology in Finance and Banking:

- Digitalizes and automates key tasks with an eye on improved customer satisfaction

- Improves security and compliance, lowers risks

- Gives access to real-time data for faster decision making

- Minimises transaction costs per branch

- Ensures better digital consolidation between different branches or banks

- Improves data accuracy

- Integrates with third party solutions

- Provides a panoramic view of data from multiple sources

- Reduces errors in reporting or data entry

- Lowers cost of ownership of IT estate

- Enables secure and seamless exchange of data between different entities

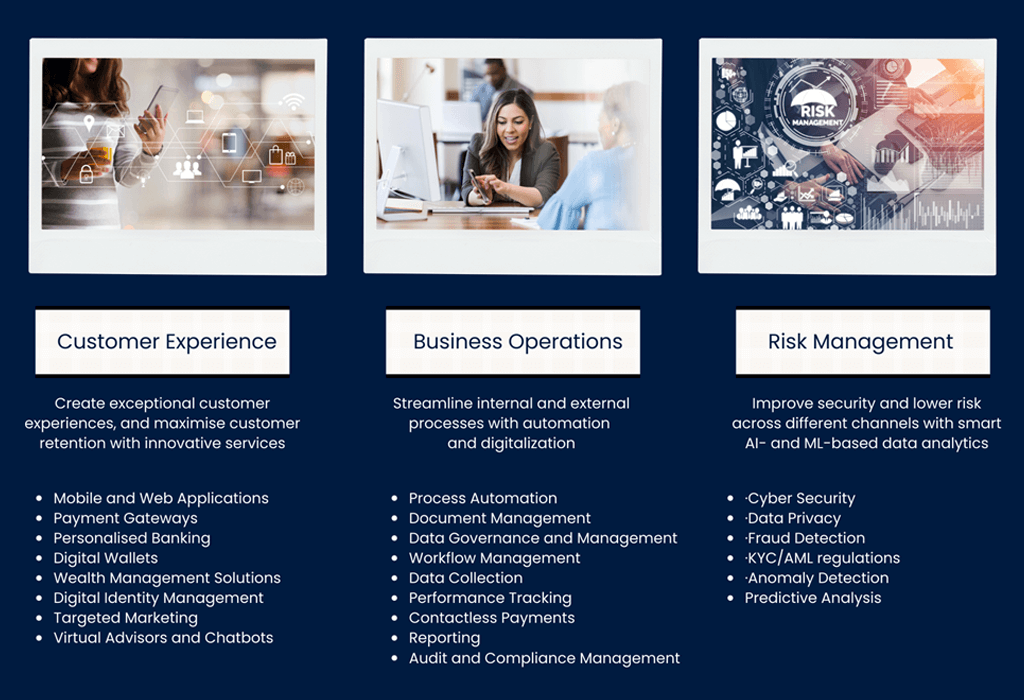

CloudLeaf's Technology Services for Empowering Finance and Banking Solutions

Technology Solutions in Banking and Financial Services

CloudLeaf helps banking and finance organizations transform their capabilities and offerings with a slew of intelligent technology solutions. We enable organizations in their digital transformative journey towards innovation, new revenue streams, and higher business value. In the process, we also guide them towards cost-effective investments in technology, such as Cloud computing, automation and digitalization to improve agility, productivity and the bottomline.

Ready to Transform Your Business?

Get in touch today with our experts.